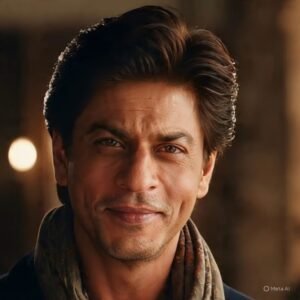

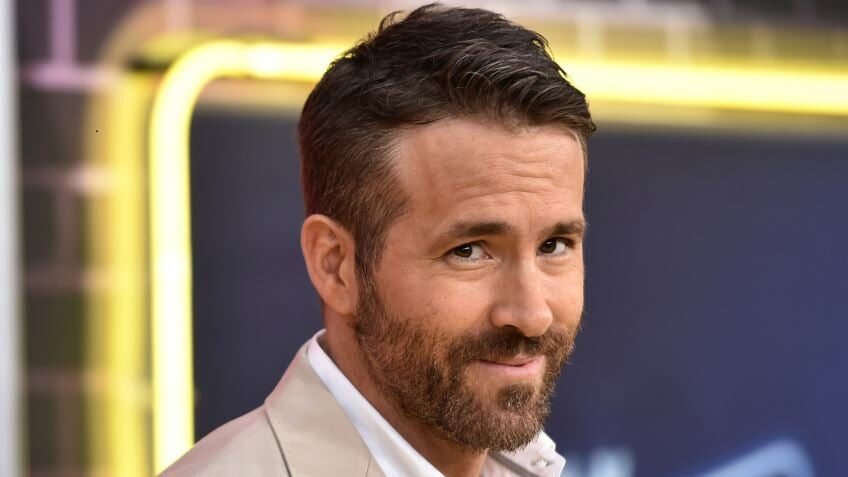

Ryan Reynolds’ Net Worth: The Strategic Business Acumen Behind a $350 Million Fortune

Introduction: More Than a Merc with a Mouth

Ryan Reynolds is widely recognized for his quick wit and charismatic portrayal of Marvel’s Deadpool, but behind the superhero persona lies one of Hollywood’s most astute entrepreneurial minds. While many actors content themselves with substantial film salaries, Reynolds has engineered a remarkable financial empire that extends far beyond traditional entertainment revenue streams. His current net worth of $350 million stands as a testament to a sophisticated business strategy that has transformed him from a successful actor into a multifaceted business magnate.

This analysis delves exclusively into the financial components of Reynolds’ wealth, examining the strategic investments, backend profit deals, and business flips that have defined his extraordinary economic trajectory. From telecommunications to spirits and sports, Reynolds has demonstrated a consistent pattern of identifying undervalued assets, amplifying their worth through innovative marketing, and executing timely exits that have collectively built one of the most impressive fortunes in contemporary entertainment.

Ryan Reynolds Net Worth: The Bottom Line

Ryan Reynolds’ current net worth is estimated at $350 million as of early 2026, according to Celebrity Net Worth . This figure represents an extraordinary financial transformation from 2017, when his net worth was approximately $21.5 million—meaning he has multiplied his wealth by more than fifteen times in just eight years . While his acting career provides a substantial foundation, the majority of his wealth stems from strategic entrepreneurial ventures and equity positions in companies that he helped grow exponentially before orchestrating lucrative exits.

Table: Ryan Reynolds’ Net Worth Snapshot

| Category | Specific Details | Financial Impact |

|---|---|---|

| Total Net Worth | $350 million (early 2026) | Primary wealth from business, not acting |

| Major Business Exits | Aviation Gin ($610M sale), Mint Mobile ($1.35B sale) | Generated hundreds of millions personally |

| Key Film Earnings | Deadpool backend, $20M+/movie upfront fees | Transformed from mid-tier to A+ compensation |

| Wealth Growth Period | 2017-2026 (9 years) | 15x increase from $21.5M to $350M |

The Foundation: Building Wealth Through Strategic Business Ventures

Reynolds’ most significant wealth accelerators have not been movie roles but rather his calculated investments in consumer brands, which he acquired equity stakes in, creatively marketed, and ultimately sold for staggering profits. These ventures demonstrate a repeatable pattern of value creation that far surpasses typical celebrity endorsement deals.

Aviation American Gin: The $610 Million Exit

In 2018, Reynolds acquired an unspecified minority ownership stake in Aviation American Gin, also assuming the roles of spokesman and creative director . At the time of his investment, Aviation was a relatively small player in the super-premium gin category. Reynolds implemented what would become his signature marketing approach—creating cheeky, viral ad campaigns that leveraged his self-deprecating humor and cultural relevance. One of his most notable campaigns was a parody response to a controversial Peloton holiday ad, which featured the same actress from the original commercial and generated billions of media impressions .

The results were dramatic. Under his creative direction, Aviation grew to become the second-largest super-premium Gin brand in the United States . This remarkable growth attracted the attention of beverage giant Diageo, which acquired Aviation Gin in August 2020 in a deal potentially worth $610 million . The agreement included an upfront cash payment of $335 million, with the remainder contingent on performance milestones over ten years . While his exact ownership percentage remains undisclosed, industry analysts estimate Reynolds owned approximately 20% of the company, which would have translated to roughly $67 million from the initial payment alone, plus potential future milestone payments . This single transaction dramatically altered his financial landscape and established his credibility as a serious business force.

Mint Mobile: The $1.35 Billion Telecommunications Coup

Just over a year after his Aviation Gin investment, Reynolds pursued a similar strategy in the telecommunications sector. In November 2019, he purchased a significant ownership stake in Mint Mobile, a low-cost prepaid mobile service provider . He again served as the brand’s creative director and public face, starring in a series of humorous, cost-effective commercials that emphasized the company’s affordable pricing and directly contrasted with the expensive, polished ads of larger competitors.

His marketing campaign emphasized shooting commercials “for cheap” to keep costs low for customers, creating a relatable, underdog brand identity that resonated strongly with consumers . This approach proved incredibly effective, driving significant subscriber growth and making Mint Mobile a major disruptor in the wireless industry. In March 2023, T-Mobile announced it would acquire Mint Mobile in a deal valued at $1.35 billion . The transaction consisted of 39% cash ($526 million) and 61% stock ($823 million) .

Based on the widely reported belief that Reynolds owned approximately 25% of Mint Mobile, his share would have amounted to around $131 million in cash (pre-tax) and roughly $205 million in T-Mobile stock . This single deal potentially added over $300 million to his net worth, cementing his status as a visionary entrepreneur.

Diverse Investment Portfolio: Sports, Tech, and Production

Beyond his two most famous business exits, Reynolds has built a diversified investment portfolio that continues to generate wealth and expand his business influence:

- Wrexham AFC: In 2020, Reynolds and fellow actor Rob McElhenney purchased the Welsh football club Wrexham AFC for approximately $2.6 million . While they initially invested in club infrastructure and experienced losses (Reynolds once joked he had lost about $12 million since taking over), the investment has proven enormously successful . The club achieved three consecutive promotions, returning to the English Football League after 15 years and dramatically increasing its value . The documentary series “Welcome to Wrexham” has generated significant additional revenue, with the club’s value skyrocketing to an estimated $129 million by 2025—a nearly 4,900% increase from the purchase price .

- Maximum Effort Production: Co-founded with George Dewey, Maximum Effort began as a marketing agency creating viral campaigns for Reynolds’ ventures but has expanded into film production . The company struck a three-year development deal with Paramount Pictures in 2021 that was extended through 2026 . While its exact value isn’t public, it represents a significant business asset beyond Reynolds’ acting roles.

- Additional Investments: Reynolds holds stakes in various other companies, including a investment in Alpine, Renault’s Formula 1 team , the Canadian fintech company Nuvei (which was taken private in a $6.3 billion deal) , and the password manager 1Password . These diverse holdings demonstrate his strategic approach to portfolio diversification across multiple industries.

Acting Career: The Foundation of a Financial Empire

While Reynolds’ business ventures now constitute the majority of his wealth, his acting career provided the initial capital, platform, and celebrity status necessary to launch his entrepreneurial endeavors. His film earnings have evolved dramatically from modest beginnings to among the highest in Hollywood.

The Deadpool Franchise: From Financial Risk to Extraordinary Reward

The Deadpool franchise represents the most significant turning point in Reynolds’ acting career, both artistically and financially. His commitment to the character spanned years of development hurdles before the first film’s eventual release in 2016. For the original “Deadpool,” Reynolds accepted a relatively modest $2 million upfront salary . However, he negotiated for a lucrative share of the backend profits, which proved to be an extraordinarily wise decision when the film became a cultural phenomenon.

Despite a constrained $58 million production budget (modest for a superhero film), “Deadpool” grossed an astonishing $780 million worldwide . Thanks to his backend participation, Reynolds ultimately earned approximately $22 million from the first film, establishing him as one of the year’s highest-paid actors . For “Deadpool 2,” his compensation increased substantially to a $20 million upfront payment, with total earnings potentially reaching $30-40 million after profit participation . The third installment, “Deadpool & Wolverine” (2024, also known as Deadpool 3), earned him a $30 million upfront salary with expectations of significant backend earnings that could triple that amount given the film’s massive $1.35 billion box office success .

Commanding Premium Compensation

Post-Deadpool, Reynolds joined the elite tier of actors capable of commanding eight-figure upfront salaries. For the 2019 Michael Bay film “6 Underground,” he earned $27 million . His 2021 Netflix action film “Red Notice” brought him $21 million , and Apple TV+ paid more than $30 million for his role in the Christmas musical “Spirited” . These substantial film fees, combined with his business success, led Forbes to name him the second-highest-paid actor in the world in 2024, trailing only Dwayne “The Rock” Johnson .

Table: Ryan Reynolds’ Major Film Earnings

| Film | Year | Upfront Salary | Backend/Total Earnings |

|---|---|---|---|

| Deadpool | 2016 | $2 million | ~$22 million total |

| Deadpool 2 | 2018 | $20 million | $30-40 million total |

| 6 Underground | 2019 | $27 million | $27 million total |

| Red Notice | 2021 | $21 million | $21 million total |

| Spirited | 2022 | >$30 million | >$30 million total |

| Deadpool & Wolverine | 2024 | $30 million | Expected ~$90 million total |

The Reynolds Formula: A Repeatable Business Strategy

Reynolds’ extraordinary financial success stems from a deliberate and repeatable business methodology that distinguishes his approach from traditional celebrity endorsements. His strategy combines strategic acquisition, authentic marketing, and perfectly timed exits.

The “Buy, Boost, and Sell” Methodology

Reynolds employs a consistent three-phase approach to his business ventures :

- Buy: He identifies and acquires a stake in undervalued companies with strong products or market positioning but limited marketing reach and brand recognition. Both Aviation Gin and Mint Mobile fit this pattern—each offered quality products in their categories but lacked the creative marketing to achieve widespread consumer adoption.

- Boost: Reynolds applies his unique marketing philosophy through his Maximum Effort agency. His campaigns leverage his personal brand of humor, self-awareness, and cultural relevance to create viral moments that generate enormous free media exposure. This “attention arbitrage” approach focuses on capitalizing on trending topics and cultural moments with quick, cost-effective productions that feel authentic rather than corporate .

- Sell: Once he has significantly elevated the brand’s profile and valuation through his marketing efforts, Reynolds executes a strategic exit by selling the company to a major industry player for a substantial multiple of his initial investment. This pattern has proven remarkably effective, generating nearly a billion dollars in combined exit value from just two primary ventures.

Maximum Effort: The Marketing Engine

Central to Reynolds’ business strategy is Maximum Effort, his marketing and production company co-founded with George Dewey. The agency specializes in what Reynolds terms “fast advertising”—creating timely, culturally relevant ads in response to current events or viral moments . A prime example is the Aviation Gin Peloton parody ad, which was conceptualized, filmed, and released within 72 hours of the original controversial ad, generating massive media coverage and consumer engagement at minimal cost .

This marketing approach effectively creates a virtuous cycle: Reynolds uses his celebrity to draw attention to his brands, the successful marketing enhances his reputation as a business visionary, and this reputation in turn creates more value for his current and future ventures. Unlike traditional celebrity endorsements where the celebrity is merely a paid spokesperson, Reynolds takes ownership stakes, ensuring he participates directly in the value creation he generates.

Asset Portfolio and Philanthropic Endeavors

Real Estate and Luxury Assets

With his substantial wealth, Reynolds has acquired an impressive portfolio of real estate and luxury assets. He and his wife, Blake Lively, own a $6 million estate in Westchester County, New York, purchased in 2012 . The property spans nearly 9,000 square feet on 11.65 acres . Additionally, they own a home in Los Angeles and reportedly purchased a $1.9 million property in Wales in 2023 . Their real estate portfolio also includes a Tribeca loft estimated to be worth between $6 million and $49 million .

Reynolds maintains a collection of luxury vehicles valued between $950,000 and $1.19 million, including models from Lamborghini, McLaren, Audi, and Tesla . While significant, these personal assets represent a relatively small portion of his overall net worth compared to his business investments and equity positions.

Philanthropic Commitments

Reynolds directs a portion of his wealth toward philanthropic causes, often in partnership with his wife. They have matched up to $1 million in donations for Ukrainian refugees fleeing the Russian invasion and donated $500,000 to Water First to provide Indigenous communities in Canada with clean drinking water . He has also supported organizations including the Michael J. Fox Foundation for Parkinson’s Research, Covenant House, and various food banks . In recognition of his humanitarian efforts, Reynolds received the Academy of Canadian Cinema and Television’s Humanitarian Award in 2023 .

Conclusion: The Blueprint of a Modern Business Mogul

Ryan Reynolds’ $350 million net worth represents far more than typical Hollywood success—it exemplifies a sophisticated blueprint for wealth creation in the modern economy. His journey from actor to entrepreneur demonstrates the power of leveraging existing platforms to build independent business empires. Rather than merely collecting paychecks for film roles, Reynolds has systematically deployed his capital, creativity, and celebrity to acquire, enhance, and monetize businesses across diverse industries.

The numbers tell a compelling story: a twenty-fold increase in net worth in under a decade, two business exits totalling nearly $2 billion in combined value, and a transition from mid-tier actor to one of Hollywood’s highest-paid stars. What distinguishes Reynolds is not just his financial success but his repeatable methodology—the strategic “buy, boost, sell” approach that has proven effective across multiple unrelated industries.

Perhaps most impressively, Reynolds has achieved this wealth transformation while maintaining his acting career, demonstrating that his business ventures complement rather than detract from his primary profession. As he continues to develop new projects through Maximum Effort, invest in sports franchises, and explore additional business opportunities, his financial trajectory appears poised for continued growth. Ryan Reynolds’ net worth story offers a masterclass in modern wealth building—a synergistic combination of creative talent, business acumen, and strategic timing that has redefined what’s possible for entertainers in the business world.

Celebrity Net Worth Disclaimer: Our deep dives into net worth are crafted from thorough analysis of public data, financial reports, and market trends. These figures are informed estimates intended to inspire and inform, not definitive statements of personal wealth. Remember, true value lies in passion and impact—not just numbers! All values are fluid and for educational purposes only.

Also Read: Blake Lively’s Net Worth 2026

Frequently Asked Questions about Ryan Renolds’ Net Worth 2026

What is Ryan Reynolds’ current net worth?

As of 2026, Ryan Reynolds’ net worth is estimated to be $350 million. The majority of this fortune stems from his strategic business exits, particularly the sale of Aviation Gin and Mint Mobile, rather than his acting salaries alone.

How much did Ryan Reynolds make from selling Mint Mobile?

When T-Mobile acquired Mint Mobile in a deal valued at $1.35 billion, Ryan Reynolds’ approximate 25% ownership stake translated to a monumental payday. He received an estimated $131 million in cash and roughly $205 million in T-Mobile stock, totaling over $336 million.

What was Ryan Reynolds’ deal with Aviation Gin?

Ryan Reynolds acquired an ownership stake in Aviation American Gin in 2018. When Diageo bought the company in 2020 for a potential $610 million, Reynolds earned an estimated $67 million from the initial cash payment alone, with the potential for more based on performance milestones.

How much did Ryan Reynolds make from the Deadpool movies?

His earnings evolved significantly with the franchise’s success. For the first film, he took a modest $2 million salary but negotiated a backend deal, earning a total of ~$22 million. For Deadpool & Wolverine, his upfront salary was $30 million, with total earnings expected to reach ~$90 million after backend profits.

What is Ryan Reynolds’ main source of income?

While he commands eight-figure movie salaries, his primary source of wealth is now his business ventures and investments. His “buy, boost, sell” strategy of taking equity stakes in companies, amplifying their value with his marketing genius, and executing lucrative exits has proven far more profitable than acting.

What is Ryan Reynolds’ business strategy called?

His highly effective approach is often referred to as the “Buy, Boost, and Sell” methodology. He identifies undervalued brands, uses his creative marketing (often through his agency, Maximum Effort) to dramatically increase their value, and then sells them to industry giants for a massive return.

Does Ryan Reynolds own part of Wrexham AFC?

Yes, along with actor Rob McElhenney, Ryan Reynolds purchased the Welsh football club Wrexham AFC for approximately $2.6 million. While an initial investment, the club’s value has skyrocketed to an estimated $129 million thanks to its sporting success and the popular documentary “Welcome to Wrexham.”

What other companies has Ryan Reynolds invested in?

Beyond Aviation Gin and Mint Mobile, Reynolds holds a diverse investment portfolio. This includes a stake in the Welsh football club Wrexham AFC (now valued at ~$129 million), his production company Maximum Effort, and investments in 1Password, the Canadian fintech company Nuvei, and an ownership stake in Alpine’s Formula 1 racing team.

How does Ryan Reynolds’ marketing company, Maximum Effort, contribute to his net worth?

Maximum Effort is the engine behind his successful marketing campaigns. While its exact value is private, it represents a significant business asset. It generates revenue by creating campaigns for his own ventures and potentially for other brands, and it holds a valuable multi-year development deal with Paramount Pictures, further adding to his income streams.

What is Ryan Reynolds’ most profitable business deal to date?

While both were enormously profitable, the sale of Mint Mobile is likely his single most profitable deal. His share of the $1.35 billion sale is estimated to be worth over $336 million in combined cash and stock, eclipsing the estimated $67+ million he earned from the Aviation Gin exit.

How much of his net worth comes from acting versus business?

The vast majority of his $350 million net worth is now derived from his business ventures and investment exits. While his acting career provided the initial capital and platform—and he still earns tens of millions per film—the billion-dollar-plus exits from his owned companies constitute the core of his fortune.

Does Ryan Reynolds donate to charity?

Yes, philanthropy is a noted part of his financial profile. He and his wife, Blake Lively, have made significant donations, including matching up to $1 million for Ukrainian refugees, donating $500,000 to Water First, and supporting organizations like the Michael J. Fox Foundation. These actions, while reducing his liquid assets, build a positive public profile that can indirectly enhance his business value

What are Ryan Reynolds’ biggest assets?

His largest assets are his ownership stakes in sold companies (the value from which is now part of his cash and stock holdings), his diverse investment portfolio, and his real estate. The latter includes a $6 million estate in New York, a home in Los Angeles, and a property in Wales, with a combined real estate portfolio valued in the tens of millions

How has Ryan Reynolds’ net worth changed over time?

His net worth has undergone a meteoric rise. In 2017, it was estimated at a modest $21.5 million. The subsequent exits of Aviation Gin (2020) and especially Mint Mobile (2023) acted as massive wealth accelerators, propelling his net worth to its current estimated $350 million—a increase of over 1,500% in under a decade.